How eCommmerce is Being Impacted by Coronavirus

and What SEOs Could Do

and What SEOs Could Do

Samuel Mangialavori

Consultant

Covid-19 has had a noticeable impact on our economy so far, there is no doubt about that. Here at Distilled<>Brainlabs, we are doing our best to help our clients understand consumer insights and behaviors during this unprecedented time. With no surprise, e-com has been very affected by such circumstances, especially in geographical areas where the virus has been more prominent.

With this post, we aim to share some of the insights we have been seeing, with the intent to help other agencies and brands gather valuable insights to emerge faster from a time of crisis.

We’ve had many clients asking:

Here you will find a list of top-level insights, gathered in the first two weeks of March. It is worth clarifying that most (not all) of the findings relate to the clothing e-commerce space, with a stronger focus on the luxury vertical.

Google Trends data for three brand queries of popular e-commerce websites in Italy, in the last 30 days vs the same brand queries in the UK.

While interest in these three brand queries dropped drastically in Italy after the events of the lockdown, we have witnessed very little to no change in UK’s trends for the same period of time – after Boris Johnson (the UK’s prime minister) addressed the nation on live TV, there has been a slight impact on such terms, which seem to be on the verge of a slight decline after the weekend.

Baidu Index data – a similar data source to Google Trends – for a series of luxury brand queries (selected based on Gartner data for China) in China since January 2020. [Enlarge image]

After a very large drop between mid to end of January, interest appears to pick up form mid-February.

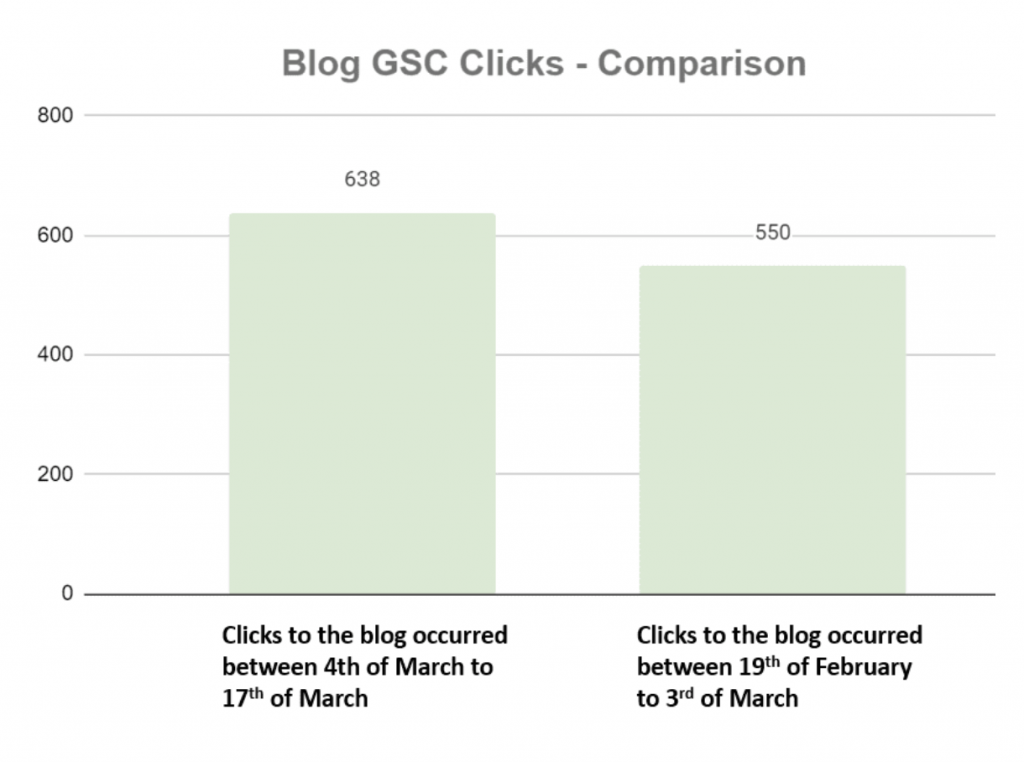

We analysed the number of clicks recorded in Google Search Console (GSC) for the blog of a client of ours based in the UK, for the following period: 19th of February to 17th of March, comparing two weeks periods. We removed all brand & irrelevant queries while focussing on the top 500 informational & navigational terms in GSC.

As shown in the bar chart above, clicks driven by the keywords analysed have seen a slight improvement from 550 to 638 clicks.

The list below contains a series of recommendations that can be applied to all e-commerce sites:

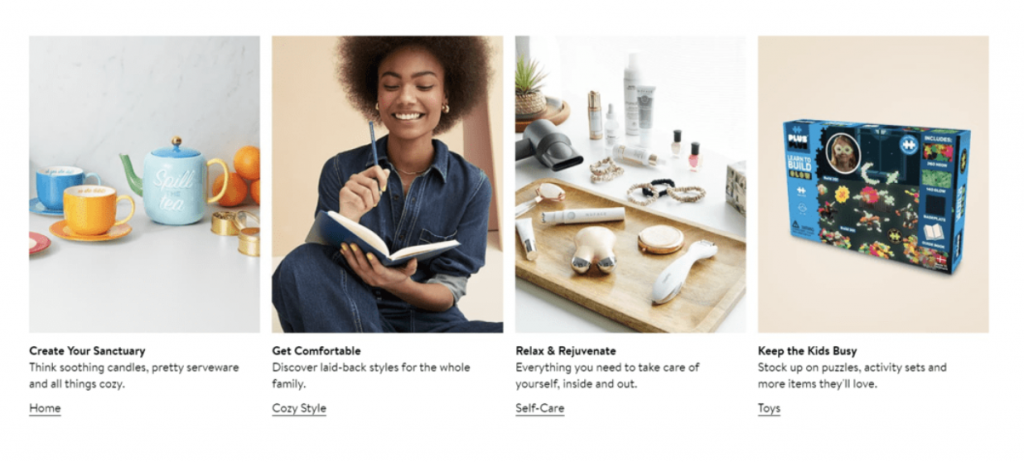

See an example here – this is Nordstrom’s homepage: they have increased the visibility of their editorial content, easily accessible from the homepage.

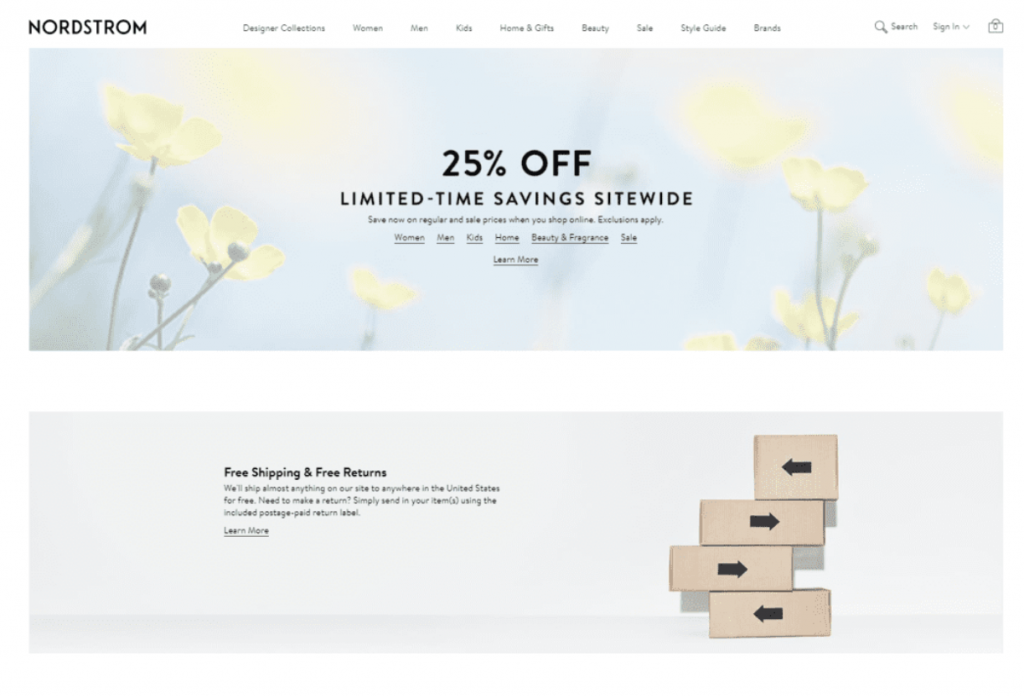

Nordstrom’s homepage appears to be a great example again.

Update your metadata (especially title tags) to highlight your online shopping capabilities and emphasise your delivery & return options.

See an example here – this is Zalando women’s dresses page

Consider making shipping policies more competitive. Some brands are offering free deliveries for lower order amounts (for instance: if you offered free delivery for orders over £100, consider cutting it to £50). Again, social media can help you emphasise this message as fast as possible.

See this Instagram post – the Italian clothing brand Gutteridge is now offering free delivery on orders over 30 Euros, while supporting the hashtag to stay at home during the lockdown.

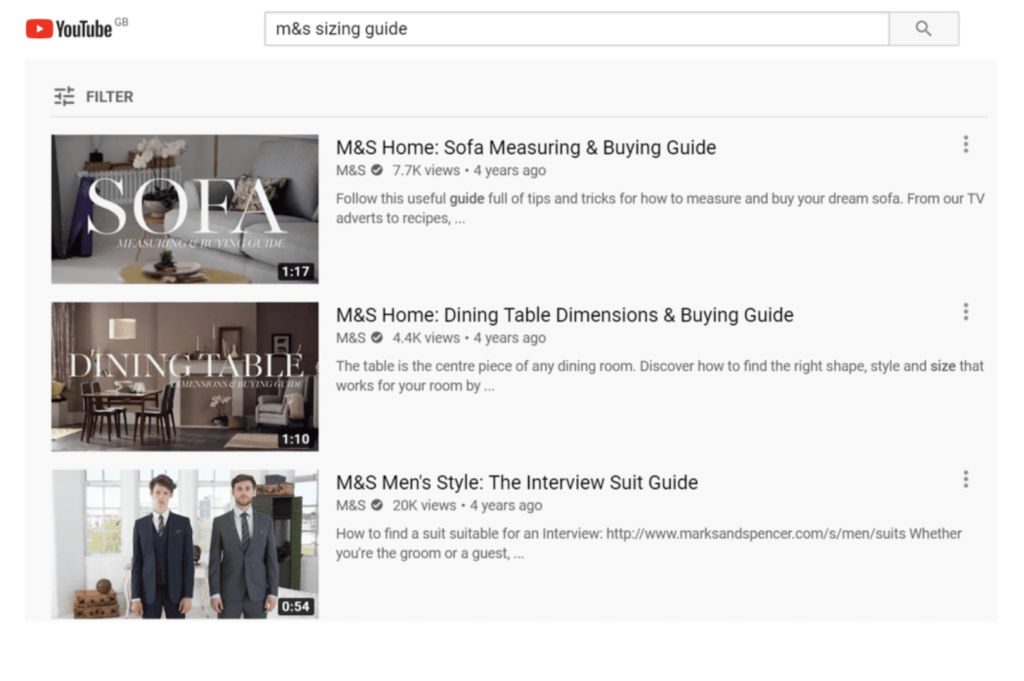

Do not forget about any video content you may have already, that can help with the above recommendations (size-charts, deliveries, returns and more), using social channels to promote it even further – YouTube is your friend here.

See an example here – M&S has a plethora of sizing and buying guide videos on YouTube that could be used to reinforce their marketing message.

We do work in the SEO space but in times like these, it is important to be objective: differently from other channels, SEO has always been a long-term play. Learning from the 2008 economic crisis (Moz post on the subject is very interesting), it is worth considering how investing in SEO now while other companies aren’t, might help you be in a better position when good times resume.

Your SEO roadmap should probably change (see the paragraph below), but your overall strategy should not vary much. To reiterate what mentioned at the beginning of the post: what we are seeing in the SEO industry is that traffic drops are drops in interest not rankings, which means this decline is driven by a change in consumer behavior and not by Google.

In terms of actual tasks and things to prioritise:

No matter what approach you prefer among the two above, editorial content should be a priority. Yes transactional terms are experiencing lower interest (hence, traffic), but people have a lot of time to browse your site and most importantly, they have a lot of time to consume digital content – whether it is from social media (read how covid-19 has created a surge in social media usage) or from search engines. Repurposing / creating top of the funnel content, together with a strong social media strategy to support it, should be your focus.

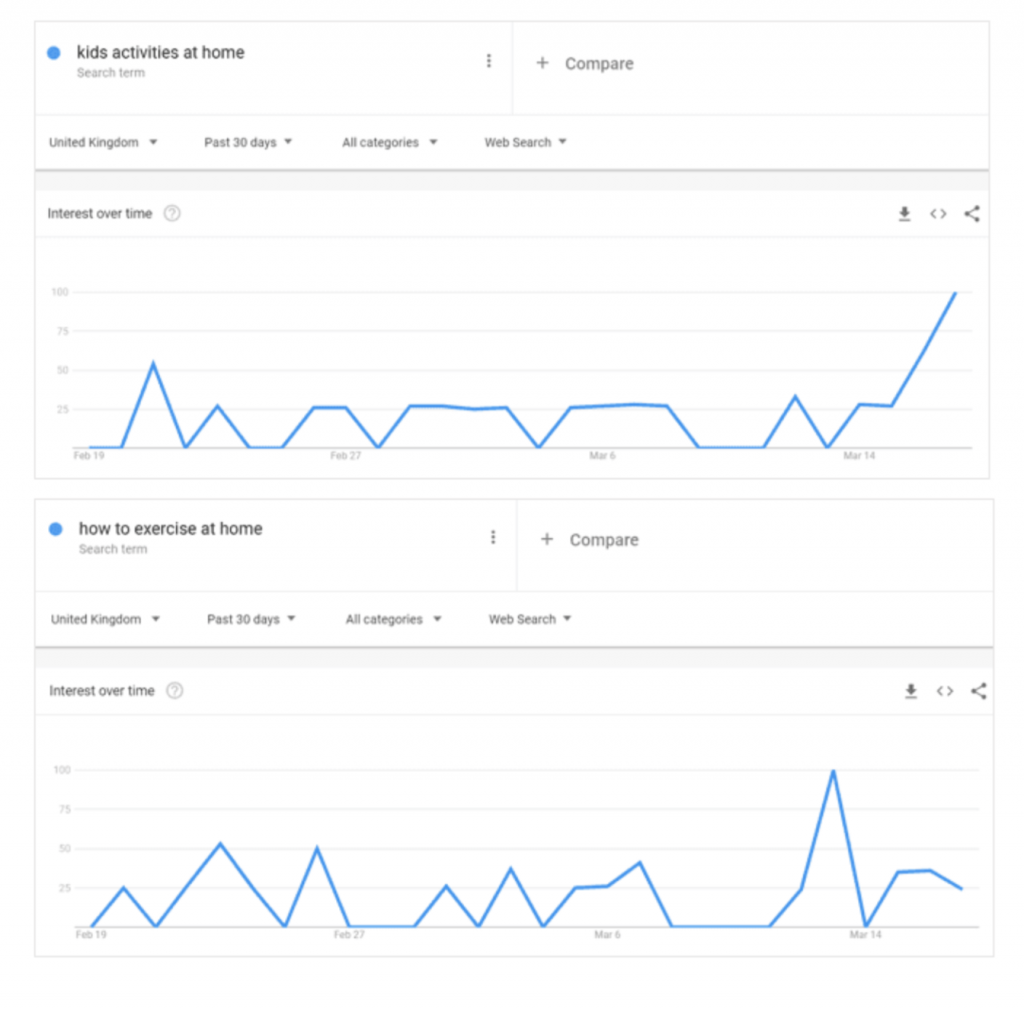

See an example of two queries that are driving a lot of interest in the last week or so: “kids activities at home” and “home exercise”.

Consider switching your attention to conversion rate optimisation (CRO). It is worth evaluating what you can do to improve the likelihood of conversions, with the low(er) traffic available to the site. Experimenting with CRO (while keeping an eye on SEO) might be worth a shot right now.

Either focus your attention on pages that have the highest organic traffic or go for bolder changes on lower traffic pages/sections that you might be typically too risk-averse to try. Experimenting with CRO (while keeping an eye on SEO) might be worth a shot right now.

Schema.org just released a new type of structure data to address the global response to the Covid-19 outbreak. In particular, two new types have been highlighted: “SpecialAnnouncement” and “eventAttendanceMode” which can support websites providing event updates in the SERP. The latter will specifically help those businesses whose events have moved from a physical location to online (find more on the event subject here)

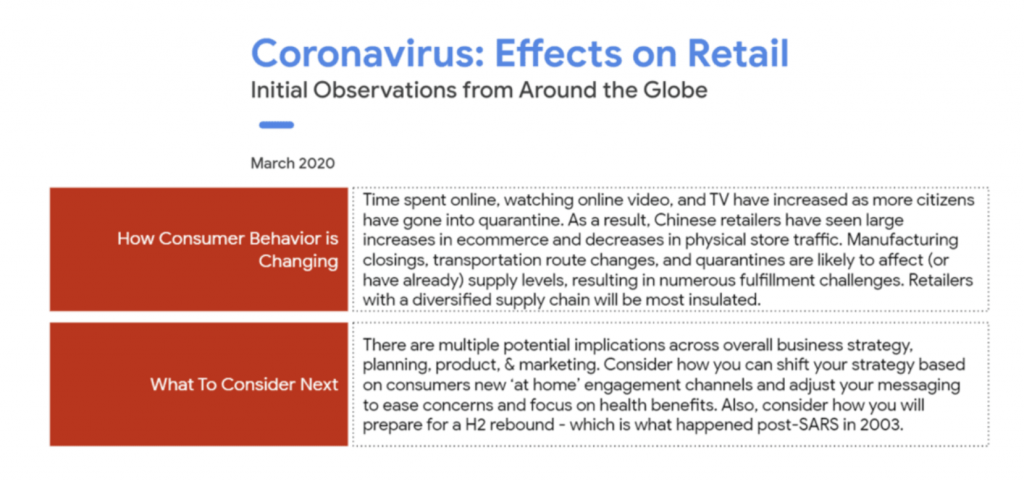

To reiterate some of the key points in this post, we have also included a screenshot from Google initial findings and forecasts on the retail industry.

Undoubtedly, covid-19 is disrupting the digital marketing space, creating a lot of uncertainty for consumers and businesses. However, there is still a lot we can do to limit its effects, while waiting for the economy to recover. The companies that play their cards right and are digitally-forward thinking, will be better positioned coming out of these tough times, similarly to what happened after SARS (2003) and the economic crisis (2008).

Sam joined Distilled in July 2018 as a Consultant. Originally from Italy, Sam studied Economics in Modena before moving to London for his Master’s degree in Strategic Marketing at Imperial College. He has over four years of experience in the industry, having worked in different fields such as Outreach & Creative, Technical SEO, and Synergies between Organic & Paid Search.